Does Bitcoin suffer from "Perverse Incentives"?

Combatting Climate Change and the "Cobra Effect": What we can learn from British Colonialists attempt to combat snakes in India.

Note: this article is intended for Liberal and Progressive Bitcoin skeptics. If you aren’t concerned about climate change, this article is not written for you.

Introduction

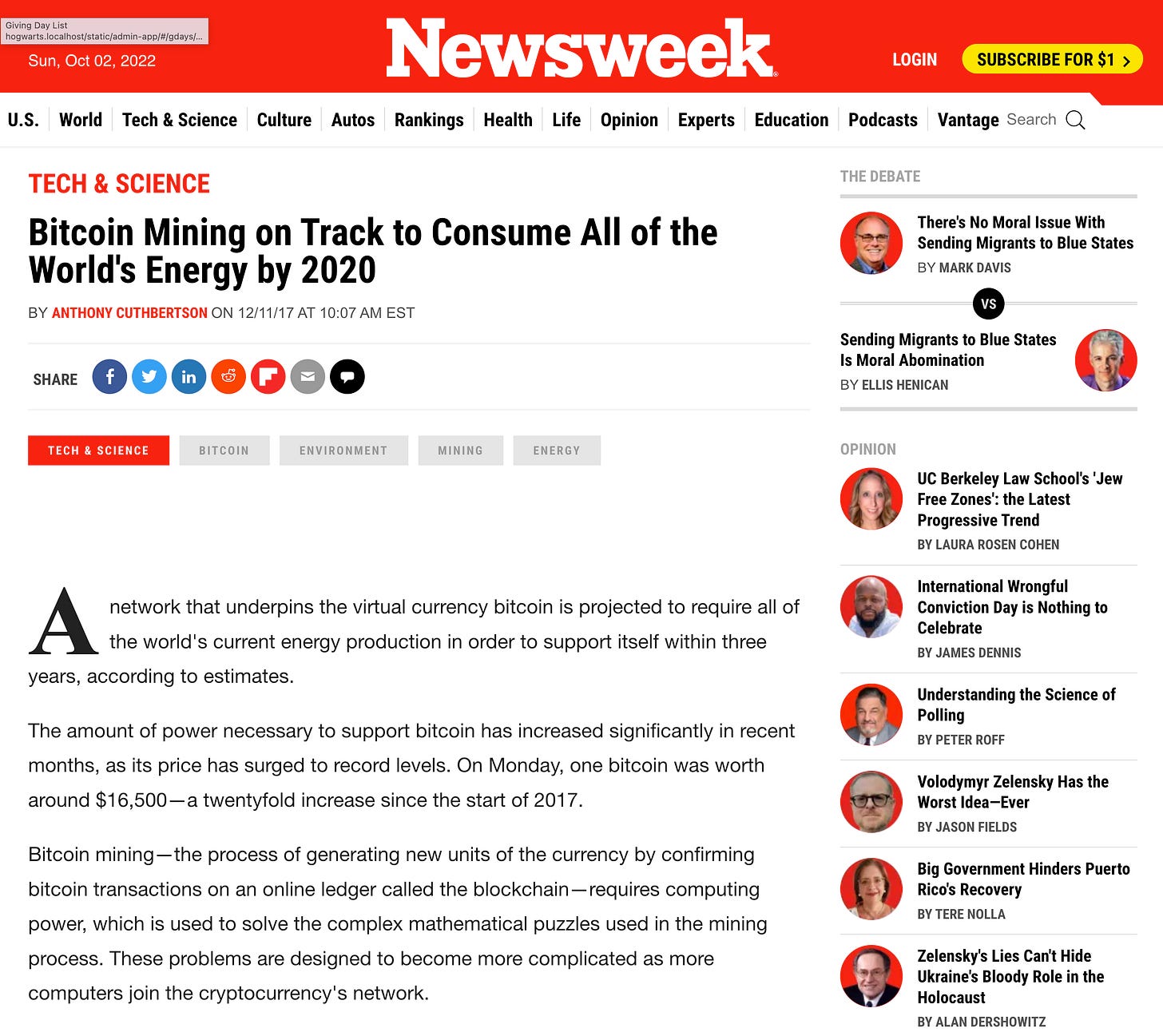

Conventional wisdom holds that Bitcoin is an environmental pitfall. Bitcoin opponents correctly point out that Bitcoin uses as much energy as a small country like Norway. In 2017, Newsweek magazine predicted that by 2020 Bitcoin would come to use all the world’s energy. 1

Fast forward to 2022 — while the anti-Bitcoin energy critiques persist, Bitcoin’s energy use remains more akin to a rounding error than to what earlier critics would have led you to believe, with one estimate standing at approximately one-tenth of one percent (0.1%) of world use.2

Understanding Big Numbers

How can such a disparity between reputation and reality exist; and why does Bitcoin have such a bad reputation as an energy hog? One part of the answer is that most people’s brains are really bad at comparing really big things. 3

Take the following survey and see if you can determine which of the following statements are untrue:

Worldwide Bitcoin energy usage is as much as a small country like Norway.

US Christmas lights use as much energy as small countries like El Salvador.4

Bitcoin energy is as much energy as the cruise industry.

YouTube videos use twice as much energy as Bitcoin.

Electrical devices that are on standby use twice as much energy as Bitcoin. 5

Gold mining and production uses three times as much energy as Bitcoin.

Bank branches and ATMs use about five times as much energy as Bitcoin.

Internet pornography uses more than seven times the energy of Bitcoin. 6 7

In 2017, Newsweek projected that Bitcoin would consume all the world’s energy by 2020.

Bitcoin today uses about 0.1% of world energy.

Most of Bitcoin's energy use comes from the creation of new Bitcoin, not validating transactions.

All the above statements are True.

All of the above statements are False.

Answer:

The correct answer is number 12 ( 1-11 are all True).11

In answer to the original statement about “small countries” — Norway’s population is about 5.4 million, which is slightly less than the Washington DC metro area, but by describing Norway as a country, our mental models frame it on world-level terms rather than as a developed country with about 0.06% of the world’s population.

Opposition from the ESG Movement

A second reason why Bitcoin has a reputation as an environmental disaster is that Bitcoin is opposed by a powerful ESG (Environmental, Social, Governance) movement that has mobilized to attack Bitcoin in favor of government-backed digital currencies and alternative crypto monetary systems like Etherium that pose less of a threat to the financial and political establishment and also now also happen to operate using less energy.

It appears that some elite interests are looking to poison public opinion about Bitcoin, or at least shift public opinion towards crypto it can control.

I wrote this article because I don’t think most people understand how much better Bitcoin is than our current system on an ESG basis. Our current system:

warps the American economy (and politics), 12

incentives war, has

disincentivized renewable energy, and

exacerbates inequality. (link to future article)

If people -- especially Liberals and progressives -- understood the bigger picture, they would welcome Bitcoin as a more ESG-friendly future alternative to the dollar,13 or at least push for a better system than we have now. I said "most" people would prefer (a more mature and less volatile) Bitcoin to the US dollar/petrodollar because there are significant and powerful interests that actually prefer a warped economy that incentivizes war, disincentivizes renewable energy, and exacerbates inequality. The problem is that it takes time for people to understand Bitcoin on a deeper level. Bitcoin is still young and volatile,14 and many people are too busy, tired, or intimidated by technology to spend time researching it.

ESG has been hijacked

We have seen that every political or economic movement runs the risk of being hijacked. Later in this article I will feature an example of “woke” anti-racism language being hijacked by a snack food company to support “food neutrality” — the idea that there is no such thing as “good” or “bad” food. This is a very convenient policy for a snack food company. I believe that the concept of “ESG” is being similarly hijacked. 15 ESG is a term used to refer to Environmental, Social, and Governance, but the positive associations people have for it can be abused.

As evidence that an ESG metric can result in counter-intuitive results, witness the fact that a prominent ESG Index recently dropped Tesla from their index, but kept ExxonMobile:

A major stock index that tracks sustainable investments dropped electric vehicle-maker Tesla from its list in May 2022 – but it kept oil giant ExxonMobil. That move by the S&P 500 ESG Index has set off a roiling debate over the value of ESG ratings.

-Tom Lyon, Professor of Business Economics and Public Policy, Ross School of Business, University of Michigan (website)

If you support the environment, I hope you will take a few minutes to read deeply enough to understand and question the fears Bitcoin’s environmental critics employ. Bitcoin may or may not make sense financially (and some have called it a ponzi scheme)16, but I think it is important not to rule it out based on a false environmental narrative.

I’ve found Bitcoin to be a surprisingly deep topic with the potential to incentivize positive change in a world where polarization, corruption, and conflict often make systems impervious to reform.

The Cobra Effect: Out-of-Control Incentives

I believe an important reason for Bitcoin’s reputation as an energy hog is that early critics succeeded in establishing a false narrative. In 2017, a Newsweek article popularized this narrative by predicting a total energy apocalypse by 2020. This narrative has created in many people a mental model akin to the type of perverse incentive that economist Horst Siebert named the “Cobra Effect”.17

Breeding Cobras for profit: “perverse incentives”

In the early 1900s, the British undertook a plan to reduce the number of Cobra snakes in India. They did this by offering a reward for snake skins. This sounds like a good strategy, but some “entrepreneurs” decided to maximize their bounty by breeding the cobras! The incentive created more demand for cobras rather than reducing supply! When the British realized that they had created a snake-farming industry, they stopped awarding the bounty, but the country was still left with a bigger snake problem than when they started.

I believe that many people are unconsciously fearful that Bitcoin mining could spin out of control in a similarly perverse fashion, with energy producers abandoning legitimate customers and instead devoting themselves to a sort of vicious circle of mining by creating a energy-hog feedback loop.

This is what Newsweek said in 2017:

The bitcoin network's energy consumption has increased by 25 percent in the last month alone, according to Digiconomist. If such growth were to continue, this would see the network consume as much energy as the U.S. by 2019, and as much energy as the entire world by the end of 2020.

2 Reasons Why Bitcoin Mining won’t spin out of control

There are at least two reasons why this prediction failed to materialize and why future Bitcoin energy growth is structurally limited from the effects of this type of perverse incentive.

Newsweek’s article didn’t understand these limitations because it:

Failed to understand how the existing financial system works in layers.

Failed to understand how Bitcoin works, using a difficulty adjustment mechanism.

1) Understand that Bitcoin grows in Layers, like the existing Federal Reserve system

The original Newsweek article assumed that all Bitcoin transactions would take place on the main Bitcoin chain. This is like saying that the current banking system is untenable because it is unsustainable to buy a cup of coffee with a Fed wire transfer.

Imagine how many billions in fees there would be if every transaction had a ~$25 wire fee!

Similarly, imagine the energy expense generated if trillions of transactions were handled on the Bitcoin main chain (leaving aside the limitation that Bitcoin’s main chain can only handle about 7-10 transactions per second). 18

The solution that our existing Federal Reserve system employs is to use layers, with upper layers handling smaller transactions and lower levels batching together the sum of upper layers.

Visa processes 600 million transactions per day but they do not actually settle the transactions with the individual banks. The work of settling transactions is done by the Federal Reserve system using banks to net the transactions’ difference into a smaller number of clearing transactions. These clearing transactions feature larger amounts and carry a ~$25 wire fee, but they enable many more low-fee debit card transactions to be cleared by a smaller number of wires.

The Bitcoin lightning network is similar to Visa in that it is a higher-level layer that handles smaller transactions, which are aggregated together and settled on the main chain (layer 1)

2) Understand that Bitcoin has a built-in “Auto-governor” to Adjust Mining Difficulty

In addition to smaller Bitcoin transactions being batched together, a second reason why Bitcoin did not grow like Newsweek anticipated is that Bitcoin’s original algorithm features an innovative “Difficulty Adjustment.” This algorithm adjusts the mining difficulty when high miner activity causes blocks to be completed too quickly (more than every 10 minutes).

In the traditional economy, high gold prices lead to more gold mining and more gold production (a feedback loop), but Bitcoin behaves differently — the difficulty adjustment algorithm makes Bitcoin mining (mining is the term for the process of validating transactions) more difficult when there are too many miners and less difficult when there are too few miners.19 This prevents Bitcoin from being mined more quickly, even if there is more mining activity. With more mining yielding only the same rewards, the relative incentive for mining declines, preventing perverse “Cobra Effect” growth incentivizes from driving a feedback loop.20

While one can never avoid all unintended consequences, one must compare our understanding of Bitcoin’s actual perverse incentives with the US dollar’s actual perverse incentives:

The US' Dollar’s perverse incentives

It is actually the US dollar that suffers from significant “Cobra Effect”-like perverse incentives. A follow-up article will contain more details about this, but here is a summary of some of the perverse incentives created by the US dollar.

(You can read a lot more detail in the footnotes which are like a bonus article at the bottom of the page).

The US dollar as world reserve currency:

Warps the US economy by strengthening the exchange rate, making it cheaper for Americans to buy a hotel room in Mexico, but more expensive to export things like manufacturing. This is good for Wall Street, buyers of cheap Chinese goods, and American tourists, but this has led, in part, to a hollowing out of rust-belt states, and populists votes accruing to Donald Trump when an overly strong dollar weakened American manufacturing exports.21

Warps foreign policy by making oil-producing countries like Saudi Arabia even more important “allies” even if the US is "energy independent" and doesn’t need to import Saudi oil, because, by getting OPEC to price oil exclusively in US dollars, Saudi Arabia has the power to maintain or weaken the US dollar as the global reserve currency.

Exacerbates inequality by subsidizing the income of Wall Street, bankers, corporate executives, and other “cantillionaires” — those closest to the “money printer” (more later in this article).

Incentivizes middle eastern wars to maintain control over how oil is priced. 22 23 24 25

Makes long wars (forever wars) financially possible without strong public support and sacrifice.26

Incentivizes demand for US debt because countries need a place to store their foreign reserves of dollars.

Incentivizes the corruption of Wall Street, government, corporate America, and the military industrial complex through financial and military ties to the oil industry and the middle east.

Disincentivized investment in alternative energy that would compete with oil, because lower global oil use would lessen demand for countries to store foreign currency reserves in treasury bills (and thereby fund US debt).27

Exacerbates global warming by creating perverse incentives for systems to stay tied to oil.

You may have thought the British had perverse outcomes relating to the “Cobra Effect” in India, but now that you’ve heard about the incentives related to keeping the US dollar tied to oil how would you rate the US dollar’s ESG score?

Is the Petrodollar a Myth?

Yes, I am aware that there have been people, such as Dean Baker, who have called the Petrodollar a myth (Oct 7, 2009)-- that there would be no difference if oil were priced in other currencies:

“.. there would be no real difference if the euro, the yen, or even bushels of wheat were selected as the unit of account for the oil market. It’s simply an accounting issue.”

.. If the dollar were still the preferred asset among oil sellers, then they would ask for the dollar equivalents of the yen or wheat price of oil. The calculation would take a billionth of a second on modern computers, and business would proceed exactly as it does today.

But this seems contradicted by recent events in Russia, where Europe and the US are not indifferent to the concept of the Petrorouble -- Russia forcing Europe to pay for oil and natural gas in roubles rather than Euros. 28

Bitcoin ESG: from “petrodollar” to “electrodollar”

An alternative model would migrate off of the “petrodollar” and onto an “eletrodollar”. In this model, currency would still be tied to energy, but the energy produced could be generated by sources other than oil.

Today the cheapest sources of energy are not hydro-carbons, but wind, solar, hydro, and perhaps one day geothermal.29 The key problem with wind and solar is that they are often intermittent and located far from residential demand.

Bitcoin mining pairs well with wind and solar power because these types of energy have to be overbuilt30 to allow an adequate generating capacity when wind speeds (and solar energy) are low. When overbuilt wind and solar power are yielding power in excess of demand, power generators have the potential to use the excess power31 to validate (mine) Bitcoin transactions. This ability to take advantage of overbuilt capacity brings down the price of wind and solar, making them more attractive sources of energy.

One fun fact about Bitcoin mining — it has the potential to incentivize greater renewable energy and win over or temper anti-climate change Texans and midwesterners who are employed in the industry. People have less of a tendency to oppose anti-climate change efforts when their paycheck is derived from a fossil fuel alternative. Over time, minds can mellow and a younger generation can change the country’s outlook.

A Less Charitable View of the Critics

While it is usually good practice not to assume ill-will by critics, I don’t think we can always assume that all ESG criticisms are made in good faith out of concern for the environment. Rather some of their criticism is likely motivated by a desire to protect power and financial privileges granted out of proximity to the “money printer”.

One term for this class of people is “cantillionaires,” a term derived from a book written in the 1730s by French Economist Richard Cantillion called “Essay on the Nature of Trade in General”.32 Cantillion observed that the people closest to the king tended to benefit most from increases to the money supply:

Cantillon also had a theory in which the beneficiaries of the state creating the currency is based on the institutional setup of that state. This essentially means, “he who was close to the king and the wealthy”, likely benefitted from the distributional choices of currency through the system. Since the 1950s, most of the world has adopted Keynesian style central banks and monetary authorities. In times of financial crises, these central banks are used to increase the money supply and use the large banking institutions and capital market players to “distribute” capital (lend), calm markets, and prevent bank closures. Time and time (sic), it is clear that in case of the U.S. capital markets, many of the major U.S. banks, large private equity houses, and Wall Street fair well after these central bank QE measures, while individual U.S. savers often witness jumps in inflation in various goods and services. Larger financial institutions get access to the QE money and make investments and lend money out.

What is the Cantillion Effect and Why is it Even More Important Now?

How Cantillionaires Raise Housing Prices for Young

ESG Cantillionaires benefit from their proximity to the money printer because they get to purchase things with newly issued dollars before the prices have had time to go up. So if they invest in real estate by buying single family homes, they pay the current price, but their purchases raise real estate prices for everyone.

When a young couple looks to later buy a house to start a family, they find the real estate market has already been bid up by the cantillionaires. Bitcoin does away with the cantillionaire privilege by making the creation of new Bitcoin subject to a very competitive transaction validation (mining) process rather than just the privilege of being the first to receive new money.

Weaponizing “Environmentalism” to protect Privilege

Manipulative people will use whatever trend or ideology supports their interests.

I recently saw a story about how a global snack-food company was exploiting the language of anti-racism to support “food-neutrality”33 guidelines that forbid “judging” the snacking on the type of sugary products the Kraft foods spinoff corporation produces — Chips-ahoy, Oreos, Sour patch kids, and Toblerone bars.

Likewise, some privileged elites weaponize the concept of environmentalism to protect the special privileges their proximity to power grants them.

We need to look more deeply into the costs and benefits of the systems that produce our goods and services, including the often unnoticed “perverse incentives.” We also need to be aware how environmentalism can be a “button” that manipulators can “push” to manipulate Liberals and progressives, in an effort to protect hidden interests and maintain our present financialized and oligarchic system.34

The more you learn about Bitcoin, the more you learn about how our present world actually works35 and how much better it could be if these entrenched interests were transformed.

Co-opting the Critics

There is a saying:

“When it comes time to hang the capitalists, they will vie with each other for the rope contract.”

I don’t want to hang anyone. Part of what I like about Bitcoin is that it has the potential to use incentives to reform systems without violence.

I find it hopeful that, even Bitcoin critics like JPMorgan’s Jamie Dimon can be co-opted. Despite Dimon’s misgivings, JP Morgan will “sell you the rope” that could take away some of his financial privilege (cantillion effect) because he knows that if JP Morgan doesn’t sell Bitcoin, other banks or financial institutions will.

One thing bankers, oil men, business people, and military industrial America know is that there is money to be made36 in Bitcoin and they don’t want to be left out, even if that means undermining the cantillion class.

The idea of ESG is good. But when ExxonMobile is included in the ESG index and Telsa is not, you know it is time to dig deeper to get more of the story. I hope Liberals and Progressives will do the work to see through some of Bitcoin opponents’ self-interested and manipulative environmental rhetoric, insist on enacting actual reforms that overcome the perverse incentives of the dollar and promote real progress on the environment, society, and governance.

Scroll down to read the FOOTNOTES section, which forms its own “bonus article”:

Bitcoin Quiz: How much do you know about Bitcoin?

FOOTNOTES:

(There are some more “meaty” footnotes further down the page)

“Analysis of how much energy it currently requires to mine bitcoin suggest that it is greater than the current energy consumption of 159 individual countries, including Ireland, Nigeria and Uruguay. The Bitcoin Energy Consumption Index by cryptocurrency platform Digiconomist puts the usage on a par with Denmark, consuming 33 terawatts of electricity annually.

"As mining can provide a solid stream of revenue, people are very willing to run power-hungry machines to get a piece of it. Over the years, this has caused the total energy consumption of the bitcoin network to grow to epic proportions," Digiconomist explains in a blog accompanying the index.

The bitcoin network's energy consumption has increased by 25 percent in the last month alone, according to Digiconomist. If such growth were to continue, this would see the network consume as much energy as the U.S. by 2019, and as much energy as the entire world by the end of 2020.”

Bitcoin Mining on Track to Consume All of the World’s Energy by 2020. Newsweek, Anthony Cuthbertson, December 11, 2017.

Video: Inflation increases consumption and environmental damage:

Complexity is a feature (for some).

A cynic may speculate that perhaps the fact that people have a hard time comparing big things is a feature, not a bug. It allows the author to endorse whatever conclusion they want.

Notice that this same framing can be done for US Christmas light energy usage:

Standby Power uses twice as much energy as Bitcoin.

200-400 TWh per year Standby electronic devices (~0.18%) .

108.4 TWh/year. Bitcoin uses approximately. (~0.063%)

170,000 TWh global total

Internet Porn usage: 35% of internet bandwidth

35% of internet bandwidth is used for pornography (video uses more bandwidth).

Total pornography internet electricity usage = 3.5% of electricity

170,000 TWh global total energy

22,848 TWh: electricity total

(electricity total * percent internet * porn percent internet) = porn usage

(22,848 TWh * 10% * 35%) = 799.7 TWh pornography usage

(pornography/Bitcoin usage)

799.7 TWh/108.4 TWh = 7.3 times

Internet Pornography uses 7.3 times more energy than Bitcoin

Higher Bitcoin Energy Estimate: 0.55%

The pornography figure is based off of a higher estimate of 0.55% of world energy usage.

How Much Energy Does Bitcoin Actually Consume? Harvard Business Review, Nic Carter, May 5, 2021

*Note that the amount of TWh that Nic Carter cites Bitcoin as using is estimated to at 110 TWh, which is actually lower than the other estimates I’ve been using for the 0.1% figure. It seems that Carter must getting a higher percentage because he is basing his estimate on a lower total world usage (perhaps the total for electricity, not energy in general).

bitcoin: 108.4 TWh (updated as of Oct 14, 2022)

electricity: 23,845 TWh = 0.45% of electricity

total energy: 170,000 = 0.064% of total energy

You can view the latest number of Bitcoin mined from an online website counter.

Created: 19,176,881 91.3%

Remaining: 1,823,118

Total: 21,000,000 Source (Oct 14, 2022)

Mining Bitcoin Consumes a lot More Energy Than Using It

Nick Carter, How Much Energy Does Bitcoin Actually Consume? Harvard Business Review, May 5, 2021.

Note: Some of the data from this article is outdated (Especially since China kicked Bitcoin miners out of the country), but the basic concepts still apply.

But the other area where misconceptions are common is in how Bitcoin actually consumes energy, and how that’s likely to change over time.

Many journalists and academics talk about Bitcoin’s high “per-transaction energy cost,” but this metric is misleading. The vast majority of Bitcoin’s energy consumption happens during the mining process. Once coins have been issued, the energy required to validate transactions is minimal. As such, simply looking at Bitcoin’s total energy draw to date and dividing that by the number of transactions doesn’t make sense — most of that energy was used to mine Bitcoins, not to support transactions. And that leads us to the final critical misconception: that the energy costs associated with mining Bitcoin will continue to grow exponentially.

Most of the Bitcoin have already been created:

19,167,325 / 21,000,000. = 91.273%

Lyn Alden would be one of my first sources for more in-depth information.

Lyn Alden: Bitcoin’s Energy Usage Isn’t a Problem. Here’s Why.

The US should voluntarily abdicate the Global Reserve Currency

The Council of Foreign Relations says that the dollar as global reserve currency has hurt exports. “[T]he cost of the dollar’s dominance to manufacturing-heavy regions such as the Rust Belt are too high and that the United States should voluntarily abdicate.”

It is Time to Abandon Dollar Hegemony: Issuing the World’s Reserve Currency Comes at Too High a Price, Foreign Policy. July 28, 2022.

ESG stands for Environmental, Social, and Governance.

I believe that Bitcoin’s “E” is not a bad as the impression critics give and its “S” and “G” is better than the dollar and every cryptocurrency.

Volatility: Still Early

It is still early. Bitcoin is still young and its volatility is still a problem for use as a means of exchange and unit of account. A more mature Bitcoin with institutional buyers would likely be less volatile.

Hijacking a cause

Bitcoin and crypto are no different in being at risk of hijacking. In this article I argue that opponents of Bitcoin are weaponizing the language of environmentalism to protect their privilege.

Is Bitcoin a Ponzi Scheme?

Jamie Dimon says Bitcoin and Crypto are “decentralized ponzi schemes.” (In May 2022, JPMorgan researchers also said it was undervalued.)

Lyn Alden has written an article addressing the “ponzi” critique.

Freakonomics did a podcast segment on the “Cobra Effect”.

They describe Bogota, Columbia’s effort to reduce traffic and pollution through license plate rationing — allowing certain cars on the road on certain days of the week, based upon their license plate number. The perverse result was that households acquired multiple cars.

The Federal Reserve supports billions of small transactions on main layer that averages only 7 transaction per second:

In 2021, Fed-wire averaged 5-7 transactions per second. These were large clearing transactions that settled millions of smaller transactions.

Bitcoin’s Difficulty Adjustment: avoiding feedback loops

We saw the value of the difficulty adjustment mechanism when China banned Bitcoin mining. When mining activity fell, the difficulty of validating transactions was lowered to enable the network to function with fewer miners. (this temporarily sacrificed a bit of security)

If a large amount of Bitcoin mining were to take place, the difficulty adjustment mechanism would make it more difficult for miners to earn a reward, disincentivizing the mining and leading to fewer miners.

One thing additional miners do is increase the security of the Bitcoin network. The idea is as the price goes up, the incentive to increase the security of the network increases.

Think of it as getting a stronger and more expensive bike lock for a more expensive bike.

In El Salvador, it is possible to buy Starbucks over the Lightning Network.

One of the Factors behind support for Trump:

Yes, I know that outsourcing is a complex issue, but world demand for the dollar as global reserve currency has made it comparatively more expensive for American exporters, like Rust-belt manufacturers.

Kissinger Negotiates Oil Exclusivity with Saudi Arabia, 1974.

In 1974, several years after the US went off the gold standard (August of 1971), Henry Kissinger helped negotiate a deal with Saudi Arabia, that strengthened the US dollar’s role as global reserve currency, at a time when the US had just defaulted on its obligations under the Gold standard.

Saudi Arabia promised to:

sell oil exclusively in US dollars (creating demand for every country to buy dollars and “invest” them in American debt — treasury bills)

save the oil profits in US treasuries (lending the proceeds back to the US government and financing the American national debt). There was even a program to sell treasury bonds to the Saudis secretly.

support the American military industrial complex by buying American weapons, initially including Vietnam-era surplus.

In return, the US promised:

to protect the Saudi Kingdom

and less widely reported, the US also agreed not to carry-out a threatened invasion (Commentary magazine 1975):

“.. There remains the argument that military intervention in the Persian Gulf would on moral grounds alone not be countenanced by domestic public opinion. Nor is it only the public that would presumably find in the act a manifestation of complete moral bankruptcy. One has the distinct impression that the foreign-policy elite shares this view and that in the certitude with which the public’s supposed reaction is diagnosed there is something close to a wish-fulfilling prophecy. It is a curious reaction coming from those who once found no great difficulty, moral or otherwise, in supporting the intervention in Vietnam or who, in finally abandoning their support for intervention, did so not on moral grounds, but because they concluded Vietnam could not have a successful outcome or that, whatever the outcome, the costs had become disproportionate to the interests at stake. Perhaps their present reaction to the prospect of armed intervention in the Persian Gulf is not so curious, though, given this record. It is not surprising that, having lacked a sense of balance, moral and otherwise, in that most painful experience, they should lack a sense of balance today, and that we should find the law of compensation—or rather of overcompensation—at work.

At issue here is not whether there is some clear moral or legal basis for justifying armed intervention in the Persian Gulf, but whether public opinion would be morally outraged by the action. Though it is not uncommon to find them confused, these are two quite different questions. There is no need for positive moral approval, let alone moral fervor, by the public so long as it consents to the need for the action. There may even be considerable gain in the absence of that element which has so often attended policy in the past. The difficulty, of course, is that the public has been long habituated to support the use of force only in cases which have been made to appear as necessary for the containment of Communism, in turn equated with the nation’s security. Could the public be induced, in the shadow of Vietnam, to support a military intervention that bore no apparent or tangible relation to the containment of Communism, itself a factor of diminishing importance in determining the public’s disposition? No one can say. Put in the abstract, the question itself may be rather meaningless. It would take on meaning only after a concerted effort had been made to persuade the public that the alternatives to intervention were laden with dangers to the nation’s well-being. Even then it remains an open question whether an administration could obtain public support, or tolerance, for intervention in the absence of events at home that, once plainly visible, would require little further effort in persuasion. In this instance, the choice might well be between a public that would oppose intervention so long as the interests at stake were not clear, and could not readily be made clear, and a public that would support intervention only when these interests had unfortunately become only too clear.

The point is worth emphasis that we simply do not know what might bring the public to support intervention in the Persian Gulf. If the public viewed such intervention as another Vietnam, they would most assuredly oppose it. But if intervention were to promise success at relatively modest cost, opinion might well move in the direction of support, and particularly if unemployment were to rise to 8 or 9 per cent. Moreover, in this instance, by contrast to Vietnam, the existence of an all-volunteer military force would preclude the painful issues once raised by the draft. Nor is it at all clear that the Left would take the same position toward intervention in the present case as it did toward Vietnam. For the effects of the current oil price on many poor countries do not endear the major oil producers to much of the Left.”

Saudi Arabia has threatened to sell oil in alternatives:

In the unlikely event Riyadh were to ditch the dollar, it would undermine [the dollar’s] status as the world’s main reserve currency, reduce Washington’s clout in global trade and weaken its ability to enforce sanctions on nation states.

“The Saudis know they have the dollar as the nuclear option,” one of the sources familiar with the matter said.

Exclusive: Saudi Arabia threatens to ditch dollar oil trades to stop 'NOPEC' - sources, Reuters, April 4, 2019.

Saudi and Chinese officials are in talks to price some of the Gulf nation’s oil sales in yuan rather than dollars or euros, The Wall Street Journal reported Tuesday, citing people familiar with the matter.

The two nations have intermittently discussed the matter for six years, but talks have reportedly stepped up in 2022, with Riyadh disgruntled over the United States’ nuclear negotiations with Iran and its lack of backing for Saudi Arabia’s military operation in neighboring Yemen.

Saudi Arabia reportedly considering accepting yuan instead of dollar for oil sales, The Hill, March 15, 2022

The dollar’s robust status as a reserve currency owes much to the strength of the US economy. But it also derives from the dollar’s ample liquidity, which is partially a result of countries maintaining pools of dollar reserves to buy oil. [buying our debt — treasury bonds]

That link was forged in the early 1970s, not long after president Richard Nixon decoupled the dollar from gold. In 1974, Washington and Riyadh struck a deal by which Saudi Arabia could buy US treasury bills before they were auctioned. In return, Saudi Arabia would sell its oil in dollars—not only enlarging the currency’s liquidity but also using those dollars to buy US debt and products. The political economist David Spiro, in his book The Hidden Hand of American Hegemony, described how Saudi Arabia convinced other OPEC nations to invoice oil in dollars, rather than in a basket of different currencies.

.. The US’ abilities to issue dollar debt and earn dollars for exports would decline, so its economy would shrink. In this situation, the dollar’s weakening may trigger a vicious cycle: capital flight away from the dollar and towards the yuan, debilitating the dollar further.

These events, experts say, are unlikely to transpire. Analyzing these contingencies, though, is a useful reminder of how much of our modern moment—from the success of sanctions to the progress of green energy—is predicated on the strength of the US dollar.

“Why it matters if Saudi Arabia sells oil in Chinese yuan instead of US dollars,” Quartz,, March 17, 2022.

Leaders who tried to sell oil in a currency other than the dollar:

The connection between American foreign policy and the pricing of oil in dollars is difficult to prove definitively because governments would never publicly announce such a policy. But note that the US elites gain financial and political power through oil being priced in US dollars.

It enables the country to fund a global military and financial empire through borrowing (deficit spending).

Here are three times oil producers attempted to sell oil in a currency other than the dollar and found themselves subject to invasion or coup:

Saddam Huessein started selling oil in Euros Time magazine, Nov 13, 2000.

Muammar el-Qaddafi wanted to sell Libyan oil as part of a pan-African gold standard. The Ecologist.

“Chavez backs dropping U.S. dollar for oil trade,” Reuters, Oct 17

The “Business Card” Allegory:

Imagine I took out my wallet and showed you my business card. “How much is this business card worth?” I’d ask you. You might comment that “there isn’t much free space to use as scrap paper,” so you may offer to give me a penny for two.

Now, suppose I made an agreement with every gas (petrol) station in the county so that gas stations only sell gas to people who have one of my business cards.

Now how much is my business card worth?

The US basically achieved this arrangement by getting oil producers like OPEC to agree to sell oil exclusively in dollars. Because countries never want to be short on oil or other imports, they save their foreign exchange reserves in dollars. The bonds that they use for their savings are loans that finance the US national debt. This allows the US to run large deficits every year without consequence.

The US dollar is a very powerful “business card”, but one of the things that keep it this way is ensuring that every driver who wants to fill up with gas shows the business card when they refuel their vehicle. Stations that don’t insist on carding their customers undermine the system, so this system requires an enforcement mechanism.

(This is adapted from Warren Mosler’s MMT Business Card Allegory)

The Cost of Forever Wars

In World War II, the government sold war bonds. In Gulf War II, the George W. Bush told the public to “go shopping,” The Afghanistan war lasted ~20 years. This would have not have been possible without deficit financing and the global reserve currency.

One of the perverse incentives of the US dollar as global reserve currency is that private military contractors have an incentive for perpetual war and congress has little incentive to restrain them. With the state of campaign financing and the government’s ability to take on debt, the government has the means to purse indefinite war.

If only we had started working on alternative energy earlier:

The US could have invested in alternatives to oil much earlier, but the risk would not only be that it would alienate significant private interests, it could also undermine our “business card” racket.

Is a Strong Rouble good for Russia?

Also note: I don’t argue that a petrorouble would be an unmitigated good for Russia. It would hurt Russian exports (that is if Western sanctions did not already cut into exports).

Deep Geothermal energy would be available to all nations:

One technology that could revolutionize energy is deep-earth geothermal. It has exciting potential not just because it could provide constant 24/7 green energy, but also because of the way it could equalize energy — every country has access to geothermal energy within 12 miles beneath their soil. Tapping into this geothermal energy would eliminate the issues we see with energy interests being concentrated in particular regions.

Being able to access energy 24/7 would leave times of the day where energy would be in excess.

Fusion tech is set to unlock near-limitless ultra-deep geothermal energy, New Atlas, Feb 24, 2022

https://www.quaise.energy/

Bitcoin supports “Overbuilding” Windpower

It is often not economical to build out enough transmission capacity to carry peak generation when wind speeds are high because line transmission is not productive when wind speeds are low. Bitcoin mining is able to raise additional revenue from high winds, lowering the cost of electricity or financing the building of additional windmills or transmission lines.

Why are windmills sometimes unnecessarily idle?

If you see windmills, you may notice times when not all the windmills in an area are spinning in operation. Those windmills that are taken out of operation at any given time could be generating electricity that could be used to validate Bitcoin transactions and earn the windmill owner extra revenue.

Let’s say our wind farm has 100 windmills which generates adequate supply at 4 mph (hypothetically). If the wind increases to 12 mph, some of the windmills may have to be shut off because there isn’t enough consumer demand or transmission capacity in the power lines to reach the whole way from the remote West of Texas to Houston.

Instead of letting the excess wind go to waste (or building fewer windmills) because it is too expensive to set-up long-distance electrical lines for capacity that will only be used intermittently, Bitcoin miners can move their computers onsite to take advantage of power generated in those extra windy hours.

Moving Electrical Demand to the Supply

Bitcoin is one of the first technologies that can move the electricity demand directly to the location where it is available, no matter how remote. In the past we built cities next to rivers or ports because that’s what made transporting the goods the cheapest, even if those cities are far from electricity sources. Because of satellite-powered internet, it is now possible to use Bitcoin mining to harness power sources that are in remote areas, far from the electrical grid. The satellite internet is fast enough to handle the data transfer needed to perform the mining (mining is just transaction “validation”) and can be done anywhere in the world.

Bitcoin makes wind and solar more competitive

What this means in practice is not that Bitcoin is competing for power with hospitals and residences. Rather Bitcoin is sucking up the excess wind power that would otherwise go unused or would have to be supplied with a more constant power source like coal, natural gas, or nuclear.

Bitcoin takes advantage of surplus power and then at times of high demand Bitcoin miners are able to shut down, making it an excellent complement for renewable energy sources that are highly variable.

The profits that the onsite Bitcoin miners make in the excessively windy hours allow the wind farm to pay for the excess capacity needed to supply the grid on less windy and bright hours. (solar). The extra revenue tapped by using “stranded energy” sources like wind and solar enables energy providers to operate at a lower average cost, making it more attractive to build out intermittent renewable energy as an alternative to more constant sources coal, gas, and nuclear.

The economist Richard Cantillion — from whom the “Cantillion effect” takes its name —had significant influence on the early development of political economy, including the works of Adam Smith, Anne Turgot, Jean-Baptiste Say, Frédéric Bastiat and François Quesnay.

Nevin, Seamus (2013). "Richard Cantillon: The Father of Economics". History Ireland. 21 (2): 20–23. JSTOR 41827152. via Wikipedia.

Using “Woke” branding to Manipulate Consumers

The Breaking Points Youtube channel did a segment about how corporations have adopted "woke" branding to push "neutral" food nutrition guidelines that are supportive of the sugar/processed food industry.

Dr Kera Nyemb-Diop, the "expert" in the video, works for a Mondolez International, a spinoff of Kraft Foods which owns brands/categories such as:

chocolates

gum and candy

chips ahoy

oreo cookies

sour patch kids

Cadbury eggs

Toblerone

ritz crackers

I looked at Dr. Kera Nyemb-Diop's Twitter feed and some of the things she says are valid.

My concern is that the snack food/processed food industry is pushing excerpts from her in a self-serving way, using "woke" and "neutral" language as a strategy to maintain/increase consumption of processed foods.

Notice also that they use language such as "providing consumers with sustainability and wellbeing info"

It's all so cynical that it validates the backlash.

Financialization:

The defining feature of financialization in the U.S. has been an increase in the volume of debt. The US dollar’s global reserve currency makes it easier for the US to take on higher levels of debt and financialize the economy.

The Federal Reserve Uses Layers to Scale:

I bet you didn’t know how the Federal Reserve uses layers to scale. You’ll learn a lot more, the more you research Bitcoin.

I’ve found that long-term Bitcoiners are much more knowledgeable about how the financial system actually works than your average mutual fund investor.

Bitcoin and Inequality:

Bitcoin is not the solution to inequality. One can only ask so much of a new technology. I hope to write an article about inequality in Bitcoin and crypto that uses the case of WorldCoin to illustrate how resistant inequality is to many types of innovation and reform.

The one good thing about Bitcoin, as compared to Etherium, is the competitive “Proof-of-work” consensus mechanism. Bitcoin validators (miners) have to continually work to remain competitive, whereas most of the big Etherium holders are early insiders. The “Proof-of-stake” consensus mechanism grants voting rights in proportion to their stake (read he who has the most money has the most votes — just like corporate shareholder capitalism) and they also get a perpetual dividend. Etherium’s model is a recipe for a new oligarchy, while Bitcoin’s model better balances power.

Bitcoin’s governance is done through a balance between developers, miners, and node operators. Anyone is eligible to perform any role.

(I should find/write an article the describes this more fully)

Making and Losing Money: Hype and Volatility

** Bitcoin can be made (and lost). One thing I do not like about Bitcoin’s volatility is that unsophisticated young people can lose money in Bitcoin and crypto that is advertised with hype. But then you could say the same thing about stocks like Gamestop.

The one benefit of the volatility is that it incentivizes more people to learn more and pay attention to important structural elements that the traditional financial system ignores.

The good thing is that as Bitcoin matures, its volatility is expected to decline as institutional investors enter the market and create a constant demand to support the price in the face of declines and also to suppress big increases.